A crisis is never fun, this one even less as this economic downturn has risen from a health concern. On top of people losing their jobs, businesses closing, and loads of wealth suddenly being wiped out, we also have a life-threatening virus to deal with. Hopefully, the world will learn from its mistakes this time around and prepare for the next pandemic, unlike during the last hundred years where little to no lessons have been learned from the Spanish flu.

Although a lot more could be said around the handling of the pandemic crisis – both positive and negative – M&A Today is not the place to do so. There are in every crisis, however, foreseeable M&A opportunities that one can prepare for as business owner and that we´ll briefly cover here.

While a crisis can help strong companies grow and further strengthen their market positions, it also tends to accelerate the demise of weaker players and of those operating in sectors directly impacted.

One person’s loss is another person’s gain…

One person’s loss is another person’s gain…

Excess of debt is one of the first factors to come to mind here, a phenomenon that became prominent in the last decades with the rise of leverage buy-outs backed by private equity funds. For heavily indebted companies with limited debt service coverage, a relatively minor disruption in their revenues could easily lead to default on their obligations. Companies with high burn rates, low performance, and those already suffering customer attrition are other common victims of such down cycles.

All of the above examples can represent solid opportunities for businesses with sufficient reserves and some patience. Talent acquisition, purchasing selected assets of a dying competitors, and more comprehensive mergers and acquisitions are all part of a wide array of options that open up to other investors and companies, provided they’ve managed to position themselves correctly to face the crisis.

… although not everything is a fire sale!

Not all acquisition opportunities that emerge post-crisis are dying businesses. On the contrary, lots of gems can be picked up in a post-crisis environment. Many conglomerates, for example, will handle these hard times by refocusing on their core segments, often opting to divest of some of their misaligned subsidiaries to strengthen their balance sheet and focus on-going investments on their core.

Not all acquisition opportunities that emerge post-crisis are dying businesses. On the contrary, lots of gems can be picked up in a post-crisis environment. Many conglomerates, for example, will handle these hard times by refocusing on their core segments, often opting to divest of some of their misaligned subsidiaries to strengthen their balance sheet and focus on-going investments on their core.

Such divestitures typically also include selling smaller divisions abroad that might be profitable and in their core segments but are now seen more complex to manage, or riskier for the overall group. These spin-offs are oftentimes once-in-a-lifetime opportunities for a local player looking to grow as they not only add volume and profits to their own structures but also typically come with solid corporate governance, manufacturing processes and controls that can contribute to raising the acquirer’s standards.

Similarly, hard times are also good times to step back and reconsider your company and its environment.

Two companies that are competing in the same space and struggling to meet their volume requirements could, for instance, be much more successful when joining forces. An economic crisis tends to be a fertile land for mergers of equals – at least on paper. Sadly, when the economic outlook is bright, ego and optimism oftentimes trump logic and good judgement, leading many companies to reject sound acquisition or merger proposals.

Strong growth and profitability are also more forgiving to mistakes. We’re seeing right now doors opening in recession-affected segments that would have been inconceivable a few years ago, as a result of the COVID-19 crisis. Be it competitors joining forces to tackle together this downturn or smaller players who – foreseeing their fate – opted to knock the doors of their largest competitors to find a home for their brands before it’s too late.

Resetting the clock

Finally, M&A opportunities also arise in post-crisis environments from business owners that survived the storm and want out. Hard times do affect us all as persons. Sadly, this time again, many have been affected harder than others, losing their jobs, homes and/or family members, oftentimes needing to restart their lives from scratch.

However, that others don’t go through those extreme cases doesn’t mean that they do not feel pressure. Lots of people come out of a crisis as different persons, and this crisis won’t be the exception. These M&A opportunities can be other great targets for the acquirer. Here, not only is the company generally healthy, but the timing could be favorable for buyers.

Post-downturn, typically a buyer’s market

This brings us to another important factor common to many M&A transactions post-crisis: multiple factors tend to drive prices down after a crisis.

On the one hand, credit availability often tightens with banks being more cautious in their internal review processes. As access to credit gets harder, investors think twice before committing to paying large premiums. On the other hand, valuations tend to take into account the historical performance of a company when projecting cash flows for upcoming years. As an economic downturn typically results in bad years for most companies, the credibility of strong short term growth tends to be widely challenged by buyers, resulting, here too, in lower offers.

These factors combined help shape post-crisis eras as buyers’ markets with lots of opportunities showing up at more reasonable valuations.

Now what?

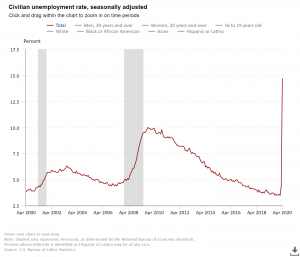

How to get ready, you’ll ask? For starters, one must first ensure that the company is well positioned to handle this crisis. Early insights, such as job losses as reported by the US Bureau of Labor Statistics as of April 2020 show nearly 15% unemployment countrywide in a sharp increase well beyond that recorded in the last financial crisis. The length and depth of this crisis are still unknown, so before thinking in M&A, business owners should first make sure their company is set to survive this downturn.

The next thing to do is plan your growth through acquisition. Consider your strengths and weaknesses as well as your top areas for growth when preparing a target profile. Your target profile should define what type of company and/or assets you can acquire. This can include such factors as revenues/profitability metrics, your ideal check size for an acquisition, geographic areas of interest, sectors of activity, product/service lines of interest, desired organizational structure, good to have/must have know-how and processes, brand positioning, etc. Finally, if you’re ready to acquire another company, it won’t hurt to touch base with your bank to inquire about availability of financing for your potential transaction.

Last but certainly not least, I would strongly recommend doing all of these steps with your investment banker and/or financial advisor as I cannot stress enough the value of preparedness and experience in these transactional processes.

Image Credits: Pixabay/Gerd Altmann, Pixabay/Saeed Kebriya, Pixabay/mastersenaiper, U.S. Bureau of Labor Statistics.

One person’s loss is another person’s gain…

One person’s loss is another person’s gain…