On October 21, 2015, Western Digital (NASDAQ:WDC 35.90 -0.79 -2.15%) announced its $19Bn acquisition of SanDisk (NASDAQ:SNDK 76.18 0.00 0.00%). Although not having any particular interest in the sector or the stocks, I’ve been following WDC’s stock from time to time out of curiosity.

Given today’s ever-growing interest for all things digital – call it Internet of Things and associated Connected Homes/Devices, wearable tech, etc – and for ever-faster computing, it made total sense for me that WDC, a company known for its Hard Disk Drives (HDD) mainly, would acquire SanDisk, one of the most recognized brands in silicon-based non-volatile memory. After all, computer and server manufacturers are rapidly moving towards Solid-State Drives (SSD), over HDD for size and performance reasons and WDC has been pretty much inexistent in the memory card segment where SanDisk holds a key position.

Sure, in the eyes of many, WDC may have overpaid for SNDK, especially given its sales performance in the last quarters. But let’s face it, what future does Western Digital have without flash memory? Wasn’t this alone worth making that bet and taking advantage of cheap interest rates to go after SanDisk?

Nonetheless, the market has spoken, repeatedly, over the last few months… against the aforementioned logic. WDC’s share were worth $83.16 when the NASDAQ closed on August 12, 2015 and are now at $40.99, literally losing more than half its value despite the announced merger. Think that’s tough? Go back another 6 months and you’ll see the shares on February 12, 2015 were trading at $107.19, 2.6x higher than right now, and that was at a time where it was already clear that the memory market was moving away from WDC’s core, HDD, towards one of SanDisk’s core, SDD.

How about SanDisk?

Well, a year ago, the stock was trading at $82.30 and hit a 52-week low of $44.28 on August 25. At the time of the announced merger, pricing SanDisk at $86.50 a share, the stock had a five-day average price of $79.60. It then, naturally, grew a bit but only to settle around its current value of $67.39…

How about that…

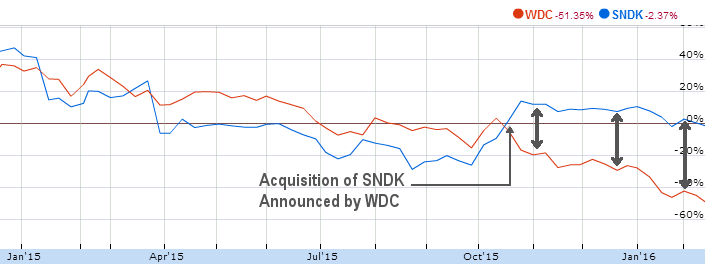

The chart on the right pretty much depicts why I’m so surprised with the outcome of this M&A announcement.

I think it’s rather self-explanatory. Keep in mind that both companies roughly have the same amount of shares outstanding (232M for WDC vs 200M for SNDK), so you can just consider that those lines pretty much represent both companies’ effective market cap on the same scale…

To put it in other words, what could have been a merger of equals reminds me everyday more of Renault’s almost adquisition of Nissan where the former, being roughly half the size of the latter, effectively controls its counterpart.

I’d resume it as: bad time to be a C-Level executive at WDC, especially given the recent news for tech companies, as pointed out by CB Insight’s recent tweet.

Image Credits: Alex E. Proimos.